asdasdg

ahfafhadfhds

Industries

Industries

Streamline your catering operations with smart automation for event management, order processing,

and kitchen workflows that enhance efficiency and customer satisfaction.

The catering and food service industry is rapidly evolving, with technology playing a crucial role in managing complex events, inventory, and customer expectations. From online ordering platforms to automated kitchen workflows, modern catering businesses need efficient systems to stay competitive and profitable.

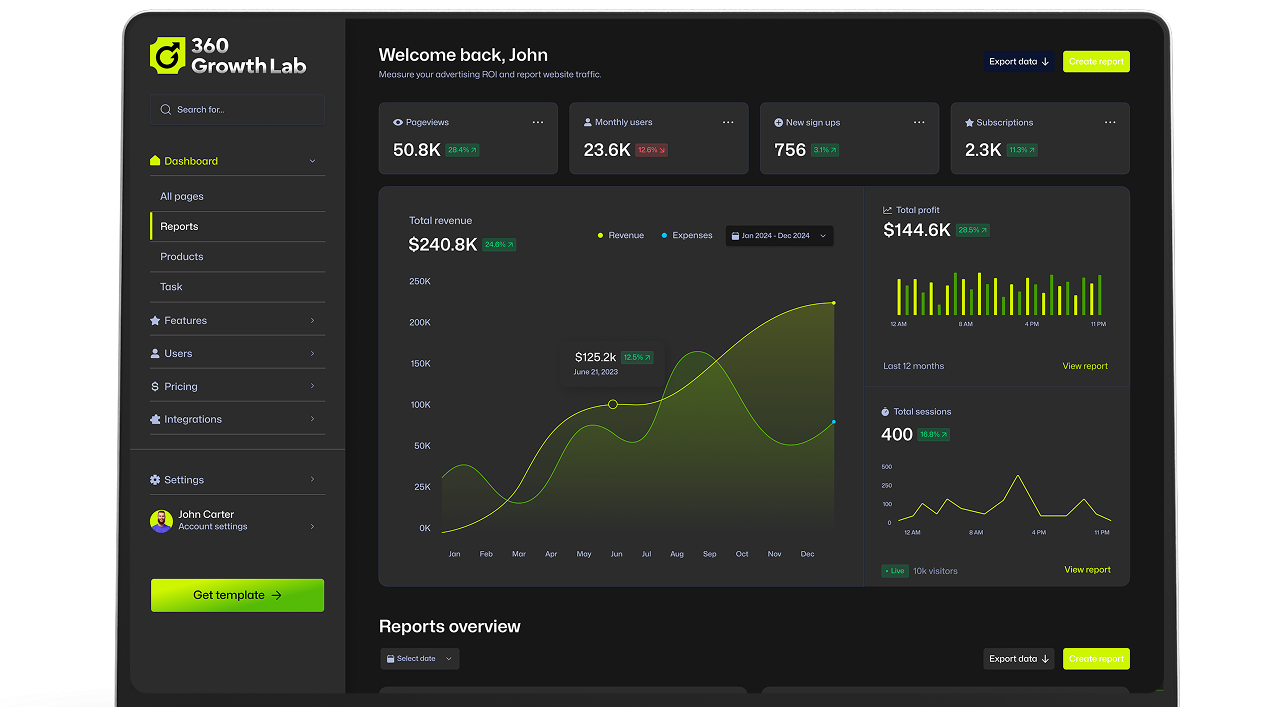

At GrowthLab 360, we develop comprehensive automation solutions specifically designed for caterers and food service businesses. Our platforms streamline event booking, menu management, order processing, and delivery coordination—helping you reduce manual work, minimize errors, and deliver exceptional service every time.

Modern catering businesses face unique operational challenges. We provide technology solutions that streamline your workflow.

Managing multiple events simultaneously with varying menus, guest counts, and special requirements. Our platform centralizes all event details for seamless coordination.

Tracking perishable ingredients, minimizing waste, and ensuring optimal stock levels. Real-time inventory updates prevent shortages and reduce food waste.

Manual order entry leading to errors and delays. Automated order processing with instant confirmation and real-time updates for both staff and clients.

Creating and managing customized menus for different clients and events. Dynamic menu builder with allergen tracking and nutritional information.

Coordinating kitchen staff, servers, and delivery teams across multiple events. Automated scheduling based on event requirements and staff availability.

Providing consistent, high-quality service across all touchpoints. Integrated CRM with client preferences, history, and automated follow-ups.

Our catering automation solutions are designed for catering companies, food service providers, event planners, and hospitality businesses looking to modernize their operations and deliver exceptional service experiences.

Real results from catering and food service implementations

Implementation typically takes 4-8 weeks depending on the complexity of your operations. We start with an MVP in 2-3 weeks, allowing you to begin automating core processes quickly while we continue to add advanced features.

Yes, we integrate with major POS systems including Square, Toast, Clover, and others. We also provide API access for custom integrations with proprietary or legacy systems.

Our system includes comprehensive menu management with allergen tracking, nutritional information, and special requirement flags. You can create custom menus for individual clients and track dietary restrictions across events.

Absolutely. We provide comprehensive training for all users, ongoing support, and detailed documentation. We also offer refresher courses and advanced training as your team grows.

Our system provides real-time inventory tracking with automated reorder points, waste tracking, and integration with suppliers. It uses barcode scanning or manual entry and provides alerts when items are running low.

Yes, our platform is designed for multi-location operations. You can manage inventory, orders, and staff across different kitchens, trucks, or event locations from a single dashboard.

We provide comprehensive analytics including sales reports, inventory usage, food cost analysis, staff performance, customer preferences, and profitability by event type or client.

Yes, we provide mobile apps for iOS and Android that allow your staff to manage orders, track inventory, and coordinate events from anywhere. The system works offline and syncs when connection is restored.